Search

-

General information about Lodgit Desk

-

Description of the menu items

-

Reservation Schedule

-

Edit preferences

- Edit the Preferences

- Edit functions of the reservation schedule

- Edit booking defaults for the reservation schedule

- Evaluate labels

- Create and manage labels

- Preferences for tax rates

- QuickCorrect: edit tax rates in existing bookings

- City / Accommodation Tax

- Preferences for payment terms and methods

- Preferences for currency

- Numbering for invoices, offers and confirmations

- Guest Preferences

- Emails

- Print and PDF Options

- Preferences for letter layout

- Settings for the sender address

- Preferences for country address formats

- Return Confirmation

- Deposit Options

- Invoicing options

- Create database backup

- Check for updates

- Settings for Proxy Server

- Preferences for accounting export

- Show EPC QR code on invoices

-

Object Management

-

- Create and delete rentable units

- Edit rentable unit information

- Edit unit's profile

- Define Features for a Rentable Unit

- Automatically change the cleaning status of a rentable unit

- Add short description for a rentable unit

- Link package to a rentable unit

- Optional: packages bookable online

- Define print options

- Statistics options

- Notes

- City/Accommodation tax for a rentable unit

-

Extras and packages

-

Create and manage price lists

-

Bookings

- Bookings

- Create booking

- Create a (group) reservation using the booking assistant

- Open booking

- Change booking status to Booked

- Change booking status to Checked In

- Change the booking status to Checked Out

- Change booking status to Disabled

- Edit booking time frame

- Move booking to another unit

- Split a booking (move into another unit)

- Add a main contact to a booking

- Edit price and price unit for a booking

- Add an agent to a booking

- Add child discount

- Add, edit and bill deposits for bookings

- Add guests to a booking

- Print registration form

- Add extras and packages to a booking

- Deleting extras from a booking

- Add notes to a booking

- View and print correspondence

- Add, edit and delete a city tax

- Create group reservation

- Remove from group reservation

- Overview over the (group) booking

- Edit the main contact of a booking

- Delete booking

-

Guest Management

- Guest Management

- Add / Duplicate / Delete Guest

- Merge guests

- Block guest

- Automatic and custom groups

- Search for a guest

- Send emails

- Write (bulk) letters and emails

- Edit guest profile

- Define guest discount

- Add and edit communicative and other data

- Add and edit notes to a guest

- Import guest data

- Export guest data

-

User Management

-

Correspondence

-

Dunning Run

-

List of unpaid invoices

-

Text Management

-

Create receipts & Cashbook

-

Financial Reports

-

Agents

-

Lists

-

Additional Modules

-

- Additional Module: Synchronisation and Channel Manager

- General settings for the synchronisation

- Settings for the Lodgit Online Booking System

- Settings for synchronising with channel manager CultSwitch

- Settings for synchronising with channel manager DIRS21 channelswitch

- Settings for synchronising with channel manager HotelSpider

- Settings for synchronising with channel manager MappingMaster

- Settings for channel manager Siteminder

- Frequently Asked Questions Regarding Channel Managers

-

-

- Kassensicherungsverordnung 2020 (TSE) in English

- Putting the TSE into operation

- Initialisation of the TSE and activation of the interface

- Working with the TSE

- Status Messages of the TSE

- Overview of functions in expert mode

- TSE Export

-

- FAQs about Cash Security Regulation & TSE

- Moving the TSE to a new computer

- The certificate of my TSE has expired - What to do?

- Performing firmware updates for the Epson TSE receipt printer TM-m30F

- Connection to local IP address not possible

- Returning to the TSE wizard if you closed the message at the beginning

- Unlock and change PINs and PUK

- Status message: "Not authorised"

-

-

-

Definitions

-

Frequently Asked Questions

- Frequently Asked Questions

- Installing the 64-bit version under Windows

- Moving your Database to a new Server

- Transfer Lodgit database to a new computer

- Download Server Database Backup

- Postpone, shorten, extend billed bookings

- Enter the opening balance of the cash register in the Lodgit cash book

- Channelmanager DIRS21: Set Up Inheritance

- Database server and license data update

- Price for final cleaning to be added to the first night's stay

- Change payment method of invoices

- Renew Your License

- Completing of the HESTA form (CH)

- Which POS systems are compatible with the Lodgit interface?

- MappingMaster - Transfer of prices and linking of extra items

- Datenbankserver: Database malformed

- Database server and "vanished" online bookings or "changing" vacancies

- How to connect Lodgit and Airbnb

- How do I delete an online booking?

- Highlight blocked dates in the Lodgit Online system booking calendar

- GoBD-export - How do you access the data during a tax audit?

- Seperate Invoices for one Booking

- Display Options for the Occupancy Plan

- Completing and setting the cash book to 0

- macOS High Sierra: Do not store database in the iCloud

- Database server error: Database is locked

- Transmitting prices and linking extra items to MappingMaster

- Use Lodgit Desk on more than one computer

- Assign Booking

- How to charge cancellation fees

- Sell and redeem vouchers in Lodgit Desk

- Create comments and remarks on invoice items

- Highlighting Special Periods in the Occupancy Plan

- Invoice with Company Address but Registration Form with Guest Address

- Email attachments will be sent to the recipient as 'winmail.dat'

- Change Language of Lodgit Desk

- cubeSQL: Disconnected / switch back to local database

-

Shortcuts

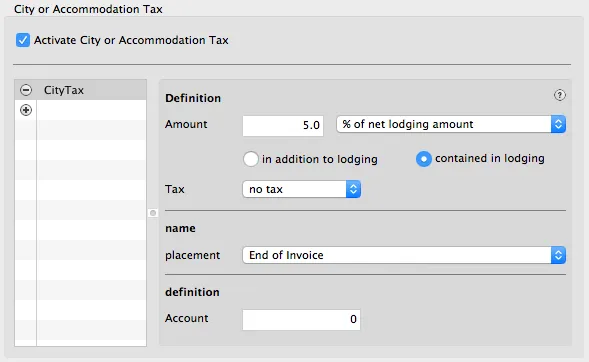

City / Accommodation Tax

Some cities and communities charge a special city/accommodation tax that is due for each tourist. Lodgit Desk offers a general setting for those.

Go to Preferences (Edit > Preferences on a Windows and Lodgit Desk > Preferences on a Mac) and then go to the tab Tax.

First, you’ll have to activate the function by checking the box at the top. Then, you can set up the tax for your property:

1. Select the amount of the tax. You can choose from a percentage amount from the gross or net accommodation price or a set amount per person, day, night or person/night or person/day.

2. Select the method for calculating the accommodation tax. Please therefore use the examples for the correct calculation published by your municipal administration.

You can choose between the following methods:

Added to the lodging rate

The percentage of the accommodation tax is calculated from the lodging rate. It is added to the end price of the lodging rate.

Included in the lodging rate

The accommodation tax is already included in the lodging rate, its percentage amount is discounted from the lodging rate. As the end price for the lodging rate already includes tax accommodation it remains the same.

Deducted from the lodging rate

The percentage of the accommodation tax is calculated from the lodging rate and then deducted. The end-price for the lodging rate and accommodation tax remains the same.

3. If the accommodation tax has some sort of VAT or Sales Tax itself, you can also define this here.

4. Finally, you can decide where the tax should be listed on offers, confirmations and invoices: beneath the lodging rate it belongs to, underneath the last invoice item, at the end of the invoice or just as an explanatory note.

5. If you want to use the Financial Export, you have to make a note of the correct account here.

If you manage more than one object and they have a different city/accommodation tax, you can also set up several taxes.

You can add the tax manually or automatically to each new booking in a unit.